Proven Ways To Make Money In Real Estate

There is no industry in the world where more money has been made than in real estate. Yet, many people still worry about getting involved in it, mainly because they feel that they need to have a significant amount of capital. However, that isn’t true. Hard money loans are just one way in which you can enter this market with little to no capital to your name.

Success Stories

There are numerous success stories out there from people who had made it big in real estate with little to no money. For instance, there is Kent Clothier Sr.

Before his career in real estate, Kent started out in the supermarket industry in the Dallas area, managing a billion-dollar supermarket operation by the young age of 32. Kent brought his expertise in the grocery industry with him to Memphis and began American Wholesale Grocers in 1987. By 1995, he built the enterprise into a $50-million venture, which he sold in the late 1990s before pursuing his passion for real estate and establishing Memphis Invest.

Another example is Dean Graziosi, who has a trailer park background and now owns more than 400 properties. There are many others like these two and what brings them together is not that they had, or didn’t have, any money behind them. It is that they had the guts to try things and now have a fantastic amount of money and knowledge.

Real estate is no more or less difficult than making money online. It is simply about knowing what you do and don’t need. One thing you do not need, which may surprise you, is good credit. You also do not need significant capital. Yes, you will have to start with the lower priced properties at first, but this is where you can start to grow. Lastly, when you start, you also do not need to have any major assets to get financing. You simply need to get creative.

How to Make Money in Real Estate

There are two key ways to generate money in real estate. The first one is the passive method, which means you buy property and hold it, by purchasing turnkey properties.

If you leverage turnkey investment properties, then most everything is already done. All you would need to do is purchase the investment property, let the professionals manage it and collect your monthly cash flow checks while your tenants help you build equity.

Your second option is to earn an active income. The most common way to do that is by flipping properties, after you have added value through renovations or development deals. The big thing to learn about, however, is how you can get your foot in the door without having a huge amount of capital. To do that, there are multiple options available to you, including:

- Lease options for seller financing

- Trading jewelry, cars, and other fixed assets you have

- Finding someone in a distressed situation and taking on their payments

- Finding an investment partner

- A loan

- Peer to peer lending

- Home equity lines of credit

- Hard money lending

If you are hoping to earn an active income through real estate, which means you will buy and sell properties in a short period of time, then hard money lending is probably the most viable option, and the most preferred one.

Hard money loans, sometimes referred to as bridge loans, are short-term lending instruments that real estate investors can use to finance an investment project. This type of loan is often a tool for house flippers or real estate developers whose goal is to renovate or develop a property, then sell it for a profit. Hard money loans are issued by private lenders rather than mainstream financial institutions such as banks.

The reason why this works is because real estate is based on a simple cash flow principle. This means that, so long as you earn more than you spend, which means you are in positive cash flow, you are doing well. Real estate investments are some of the best investments around to generate continuous positive cash flow, which is why they are so popular, and why so many people have literally made millions of dollars doing so.

8 Key Strategies to Make Money in Real Estate

There are eight key strategies that you could consider if you want to make money in real estate. You could decide to focus on one strategy at a time, or you could combine them in ways that are suitable to you. You are likely to find that, as your incoming cash flow increases and your assets and savings increase, it will become easier to make money in multiple ways, thereby also increasing the speed with which you make more money in real estate. The eight strategies are:

1. Investing in long term residential rentals, which is a passive form of income with a lot of security: people always need somewhere to live.

2. Taking out lease options, which is a perfect starting point in which you lease a property while also having the option to buy. This is a good option if house prices are going up, because you will have set the purchase price before this increase.

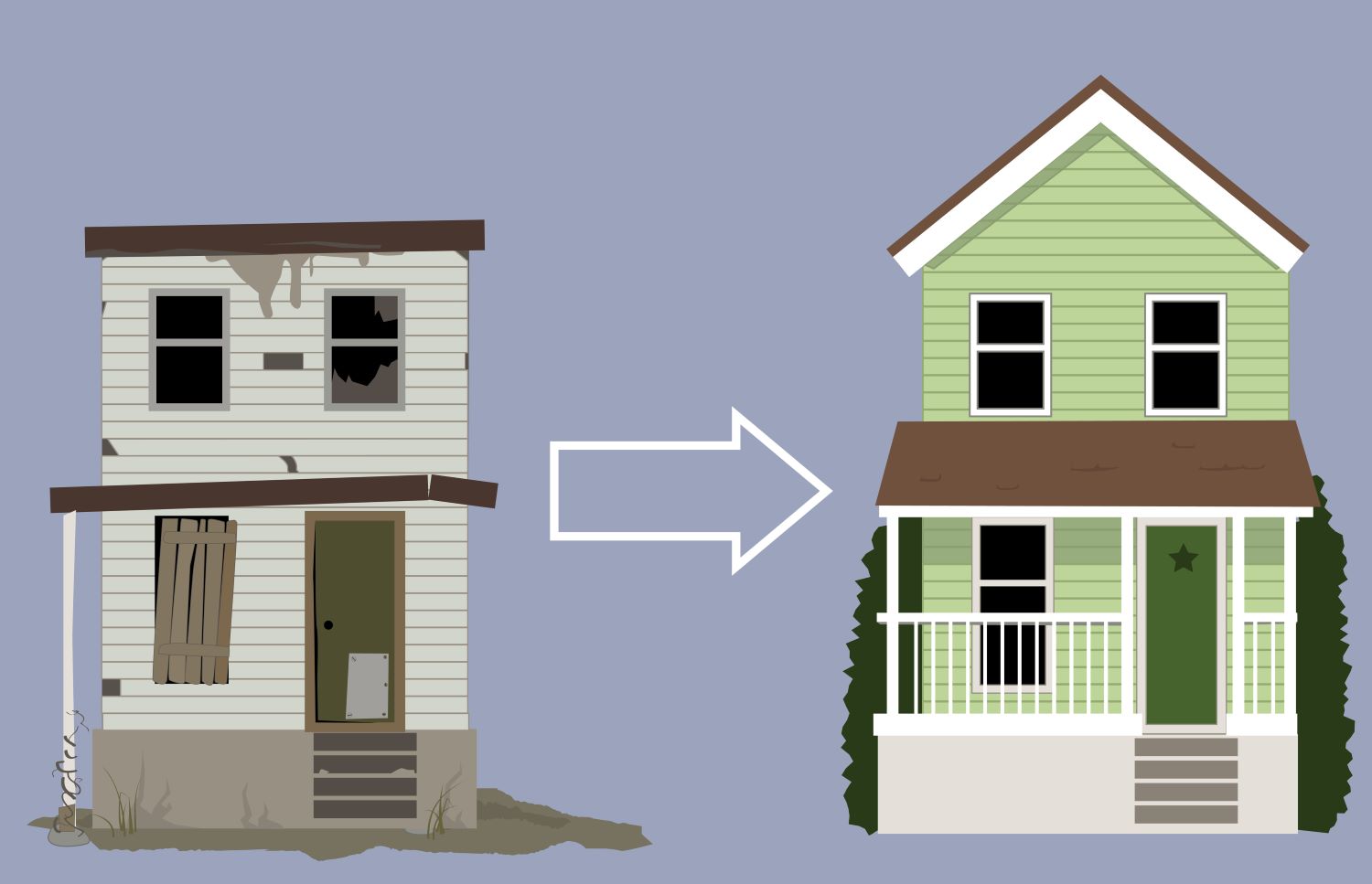

3. Home renovation flipping, for which you either need quite a bit of cash behind you, or a good relationship with a hard money lender. In this case, you purchase cheap and distressed properties, fix them up, and sell them for a significant profit.

4. Contract flipping, which means that you find people who are willing to sell at a ridiculously low price, and bring them together with an investor looking to buy. This means that there is less risk for you, because you will never have to close escrow either. However, it is quite tricky to identify these properties.

5. Short sales, which means you find those who are willing to sell their property for far less than it is actually worth, and certainly less than the balance outstanding on their mortgage. This is generally accepted if a quick sale is needed to avoid foreclosure.

6. Purchasing vacation rentals, which is a great way of earning a passive income while at the same time having a piece of property that you can use yourself if you are on vacation. By working with a good property manager, there is not much you need to do to earn your income.

7. Through hard money lending, which you will probably only be able to do once you have been involved in this field for quite some time. When you first start out, you will look for hard money lenders to help you get on the ladder. But as you continue, and if you are successful, you can become a hard money lender yourself. There is a lot of profit to be made in these loans, and the risks are very low.

8. Investing in commercial real estate, which you will probably only be able to do once you are truly established.