What Can a Hard Money Lender Do For You in Today’s Market?

Do you have a small business that needs some extra funds? A hard money lender might be the answer to your financial problems. Learn more about how hard money lenders can give you the loan you need to stay in business.

How Hard Money Lending Works

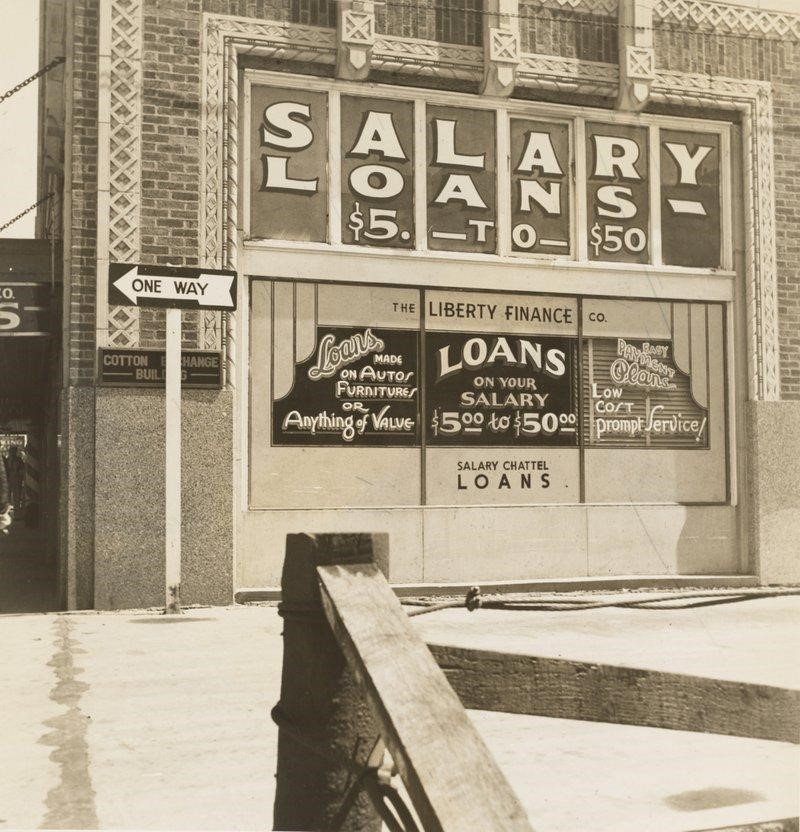

Have you tried to take out a loan with traditional banking? They often deny your request if you have bad credit or don’t have proof of a steady income. It makes it nearly impossible to keep your business running without some extra financial assistance. Therefore, some small businesses or startups have to resort to hard money loans.

Quick Hard Money Lending Process

You can easily apply online for a hard money loan as soon as you find a few that you can trust with your business. The significant part about hard money loans is everything is faster, from your application acceptance to getting the money you might need right away.

This can come in handy for those trying to build businesses such as flipping properties. If you depend on traditional banking, it might take too long to buy the property you have your eye on. Or to get the materials in time to get those renovations done. Sometimes fast money can be crucial to the success of your business when you are flipping properties or other similar businesses.

Don’t Need A Good Credit Score for a Hard Money Lender

Do you have bad credit? It doesn’t mean an instant denial of getting a loan when you go through hard money lending. Instead, a hard money lender can help you where banks and credit unions will usually deny your request when your credit is too low.

According to the Senate Committee on Banking and Financial Institutions, hard money loans are for “people with tarnished credit, whose low credit scores render them ineligible for more traditional forms of credit.” You don’t have to worry about having any other alternatives to save your business from bankruptcy.

Hard Money Lender Policies

Like with any loan, it’s better if you check each hard money lender’s policies. They will all give you different estimates on how much money you can borrow. This can be good since you find out which one offers the best deal possible, meaning you get to borrow enough without having to worry about any additional fees.

These lenders will all have different rules on any fees or points that they will charge you. So, make sure you know what each lender’s policy is with their hard money loans. These fees or points can add up to a lot of money if you aren’t careful.

Downfalls of Using a Hard Money Lender

Hard money loans sound good when you have nowhere else to turn to. However, don’t be too hasty in accepting the first offer presented to you.

High-Interest Rates and Points

Since you have to repay the loan faster than traditional lenders, prepare to pay more than you borrowed. As reported by the Senate Committee on Banking and Financial Institutions, hard money lenders give you a shorter amount of time to repay the loans.

So, this means you might have higher interest rates and points than traditional loans. Those interest rates and points can be high, so always think it over before signing up with any hard money lender.

Get Legal Advice Before Signing

A hard money lender can be helpful for businesses, but you also have to be careful with the paperwork involved. If hard money loans are your last resort, then this will make you vulnerable. They might try to add clauses that you might not understand that will add stipulations even after you repay them their money.

You should have the clauses in your deal looked over by someone who can give you legal advice on it. If you don’t, you might get yourself into something you didn’t know you agreed upon.

Are you ready to get a hard money loan? If your business is in danger of shutting down before it begins, you might need to look into getting this loan. It can save you from having to pull the plug on your business before you can make your dream job a reality. So, why not look into getting help from a hard money lender? You can go over your choices with your family or business partner and see what the best option for your business should be.

Sources: https://sbnk.senate.ca.gov/sites/sbnk.senate.ca.gov/files/final%20backgrounder.pdf